QMines’s Mt Chalmers rides on strong PFS results as it seeks to be Australia's first zero-carbon copper producer

- Noel Ong

- May 14, 2024

- 4 min read

Updated: Mar 5

On a path to becoming Australia's first zero-carbon copper producer, QMines Ltd (ASX:QML) is bolstered by robust pre-feasibility study (PFS) results for its flagship Mt Chalmers Copper and Gold Project in central Queensland.

Encouragingly, the PFS demonstrated that Mt Chalmers is a technically and financially robust project.

“With improving base metals prices associated with supply constraints, Mt Chalmers represents a low cost, high margin and long-life project with immediate upside from three satellite deposits and a large exploration package,” said chairman Andrew Sparke.

This development comes as copper prices hit a 15-month high, increasing by 15% in just two months, amid growing concerns over supply constraints and an escalating demand forecast.

The supply concerns, underscored by years of underinvestment, project shutdowns, and a scarcity of significant discoveries, are set against a backdrop of heightened global demand driven by the energy transition’s reliance on copper.

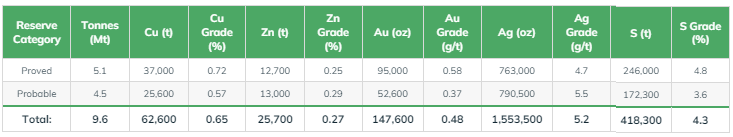

Furthermore, QML has also declared a maiden ore reserve of 9.6 million tonnes of proved and probable resources from the PFS (Figure 1).

Figure 1: Mt Chalmers JORC 2012 Ore Reserve Estimate, Proved and Probable category contained metal and grades. (Source: QMines)

Key outcomes

The PFS assesses the development of a standalone copper and gold mining and processing operation at Mt Chalmers, utilising a three-stage open pit operation and processing that material onsite.

Highlights of the study include:

supports stand-alone 1Mtpa process plant;

capital cost estimate of A$191 million;

initial mine life estimate of 10.4 years;

life of mine revenue of A$1.64 billion;

life of mine free cashflow of A$636 million; and

net Present Value (NPV8) of $373 million, 54% IRR.

Meanwhile, metals produced during the initial life of the mine include 65,000 tonnes of copper, 160,000 ounces of gold, 30,600 tonnes of zinc, 1.8 million ounces of silver and 583,000 tonnes of pyrite.

An immediate upside of the PFS is the significant growth options identified with the Sulphide City, Scorpion and Woods Shaft deposits not currently in the mine plan.

Figure 2: Key PFS outcomes and assumptions (Source: QMines)

About Mt Chalmers

Mount Chalmers is situated 17 kilometres Northeast of Rockhampton in Queensland (Figure 3).

The company owns 100% of the project which includes the high-grade historic Mt Chalmers copper and gold mine.

The project comprises 316 square kilometres of tenure that include a number of known VHMS deposits not currently in resource demonstrating significant growth potential.

Figure 3: Location and Infrastructure at the Mt Chalmers project. (Source: QMines)

Mt Chalmers already hosts four known deposits, two of which (Mt Chalmers and Woods Shaft) are currently in resource.

Significant upside remains as QMines seeks to convert two other deposits into resources (Botos and Mount Warminster) and by making further discoveries.

Encouragingly, the mineralisation is near surface, relatively flat-lying and remains open in a number of directions.

As a shallow high-grade deposit that is close to the coast and has significant infrastructure, QMines believe that substantial value may be unlocked by transitioning towards production.

Thoughts from Samso

QMines is what we could call a boutique copper producer. It does not have a big resource to have a Life of Mine of 30 years and it does not have very high grades. What QMines has is a Pre Feasibility Study (PFS) that points to a low CAPEX and a good revenue with an Inter Rate of Return (IRR) of 54%. What that is indicating at this stage is a robust money-making product.

For those who have followed the Samso journey of content, you will know that the end game for companies like QMines is to return value to shareholders. Good management is critical and after speaking to Andrew Sparke, I feel that there is truth to the madness in this sector.

The journey for QMines has been almost 3 years and the journey has been hard and full of hurdles. For the long and suffering shareholders from the listing in 2021, this is a hard pill to digest. The copper price is now at an all-time high and the narrative for copper is at its strongest. Traditional copper supplies are being stretched and their cooperating costs are only going to go up.

Do your own research (DYOR), speak to Andrew and formulate your own opinion. My thoughts are that luck which is being manifested in good demand, good narrative, good pricing and a future lowering in borrowing cost makes a nice soup for those looking for exposure in the copper producing sector.

Look out for our Samso Insight discussion with Andrew Sparke which will be released soon.

Get Deeper Insights

The latest and most reliable information from experienced sources, that are completely unbiased are now available through a Paid Membership. Sign up here for a more trustworthy source of well-researched and independent information for investors.

-------

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

------

About Samso

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments