Cobra Resources Plc - A conversation with Rupert Verco

- Noel Ong

- Mar 23, 2024

- 7 min read

Updated: Oct 16, 2024

I have known about Cobra Resources Plc's story for a while, but as they are listed in the UK, it is hard to learn what they are doing to advance their projects in Australia. The gold explorer turned Rare Earth player has some interesting points for their Rare Earth story.

I met Rupert Verco at the beginning of 2023, and he struck me as a guy who had a firm understanding of his project in South Australia. He has a good view of the direction his REE project needs to take and the technical milestones. As I am always learning and turning myself into an expert by talking to industry experts, I was impressed to learn his thoughts.

The Rare Earth industry is unique, and I am sure to many investors, as it is a new concept (for us anyway) and it isn't very easy. Market dynamics are not simple, and they are changing beasts.

What is Cobra Resources story?

Cobra Resources is a UK-listed exploration company focused on advancing the discovery of the Boland ionic REE. It is currently Australia’s only ionic rare earth project within situ recovery (ISR) potential. Through ISR, we aspire to define a magnet and heavy REE project that can be cost-competitive with the Rare Earth Mines of China.

Over the last two years, the company has been advancing the Wudinna project, located in the Gawler Craton in South Australia. Two years ago, we identified rare earth elements (REEs) within Saprolite directly above our defined gold resources. As we worked to grow the gold resource, which now sits at 279,000 ounces, we spent much time understanding the geological, chemical, and environmental catalysts that influence REE mineralogy.

Through this work, we identified relationships between mobility and acidity that had some influence on metallurgical recovery. We re-tested a significant number of historic drill samples, which enabled us to define a complimentary 41.6Mt REE resource that overlies the existing gold resource.

Through considerable testing, we determined the primary enrichment of REEs and demonstrated relationships between chemistry and secondary enrichment in saprolite clays.

Last year, we tested an alternate model for ionic REE, believing they could achieve superior metallurgy under different geological conditions without overcoming costly metallurgical processing challenges.

The Boland prospect is a younger Palaeosystem that hosts interlayers of permeable sands and reduced, organic-rich clays. Drilling in 2023 confirmed grades within these sediments with heavy rare earth enrichment. Subsequent Metallurgy testing by ANSTO yielded recoveries of magnet REEs of up to 79% Tb, 67% Dy, 60% Nd and 47% Pr via a simple AMSUL wash at a pH3, confirming the ionic nature of mineralisation.

What challenges do you face regarding your REE strategy, and how do you plan to overcome them?

Cobra’s strategy is to focus on three key components that will demonstrate the value of the boland discovery: scale, grade concentration, and in-situ recovery.

Scale: We are re-assaying historic uranium-focused drilling for REEs. This demonstrates ionic REEs across massive scales within these paleo systems and enables us to identify higher-grade targets over our >4,000km3 landholding.

Grade Concentration: Initial results support high grades concentrated within or in contact with geology with high permeability. This is important as it enables efficiency in insitu mining and reduces acid consumption.

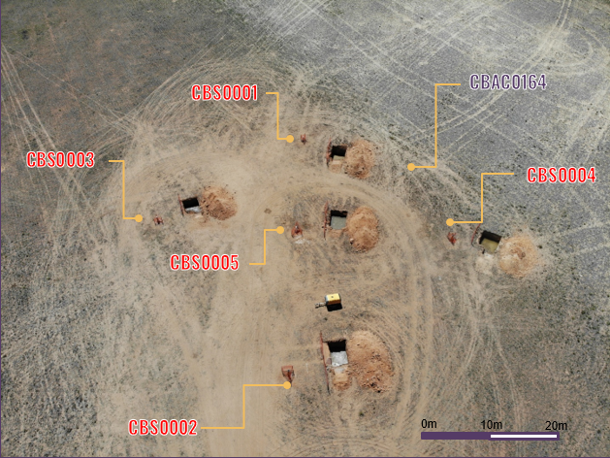

Derisking mining via ISR: Earlier this year, we completed a sonic core programme to improve our understanding of mineralogy and the geology's amenability to ISR. We were so encouraged by what we saw that we screened and cased the holes in a wellfield configuration (see Figure 1 below). We are currently gathering environmental and hydrology data from these holes to support an infield pilot ISR study—a world first.

Figure 1: Overview of the wellfield infrastructure that is intended to be used for a near term ISR pilot study.

We currently have core samples at ANSTO, who are performing column leach tests under ISR conditions. These tests will go a long way toward demonstrating the value of ISR and enabling us to commence the process of defining a flow sheet to produce a saleable product. We plan to partner with water-cycle technologies and their membrane desorption technology.

Figure 2: Mineralised core from recent sonic drilling, where high grades occur within highly permeable geology amendable to cost-effective in-situ recovery mining.

Which exchange are you listed on in the UK? What are the advantages of listing in the UK, and what are the challenges?

UK main market listed – Our advantage is that we are the only ionic rare earth company listed in the UK, which gives us good reach into Europe. Our challenge is that liquidity and investment into mining equities within the UK have not had the same success as ASX-listed resources stocks in the last ten years.

Our market valuation hasn’t had a re-rate on the back of the Boland discovery comparable to the market success of the Brazilian-focused companies. We hope to address this by delivering exploration success that yields scale, concentrated grades and de-risks in situ recovery.

Can you give us a Geology 101 on your REE project?

The project sits within the southern Gawler craton – Hiltaba suite intrusives are directly related to IOCG mineralisation.

We spent a lot of time understanding the process and mechanisms for ionic rare earth mineralisation. This was gained through identifying REE enrichment within Hiltaba suite granites, the catalysts for mobilisation, and the chemistry that promoted enrichment within clay horizons.

Figure 3: Cobra's geology model for paleochannel hosted ionic rare earth mineralisation – where mother nature has completed the expensive process of hard rock rare earth extraction and mobilised valuable REEs to an accessible storage bank, allowing for a simple and cost-effective withdrawal

What we found within the saprolite:

There were correlations between REE enrichment and changes in acidity/alkalinity; however, there was little improvement in ionic desorption metallurgy.

REEs were not present in highly acidic saprolites.

The primary and secondary bearing REE mineral phases were low in quantity, and therefore, the majority of REEs were likely colloidally bound within clays.

This leads us to theorise that:

REE mineralisation within kaolin saprolites was unlikely to be retained in ionic phases under current environmental conditions.

Due to extremely acidic ground waters, REEs were likely mobilised elsewhere.

Younger sediments hosted within the Paleosystems were likely anoxic, had large changes in chemistry, and retained the right conditions for REE mineralisation in ionic form.

Are there other commodities in your portfolio?

A 279,000 Oz JORC gold MRE overlain by a 41.6Mt 699ppm TREO clay-hosted REE JORC MRE.

There is 4km of defined sandstone-hosted Uranium at the Yarranna SE prospect, where there are numerous intersections above 500ppm U3O8.

What is the News Flow for Cobra for 2024?

Sonic Core drilling results (March)

Modelling of Mineralised Scale (March)

Re-analysis of 240 historic drill samples (April) confirming scale at Boland

ISR column leach tests (ANSTO) late April-May

Additional historic drill hole re-analysis (May)

Aircore drilling – Resource focused (June-July)

What can you say to convince investors to position themselves in Cobra Resources?

Cobra has demonstrated technical excellence in discovery while diligently using capital and preserving its share value through tight placings and sourcing non-diluting funding. We have de-risked ionic metallurgy, with initial metallurgical results comparable to highly valued Brazilian ionic projects (such as the Meteorics Caledria project).

By demonstrating Scale, Grade Concentration, and in situ recovery, we believe we can demonstrate the world-class significance of this new style of ionic rare earth mineralisation as a low-cost, environmentally superior source of heavy and magnet rare earths. Unlike Meteoric, the valuation upside to this discovery has yet to be realised!

A Word From Samso

Cobra is very different from the typical Rare Earth story that is currently being told. Readers will know that Samso has a few clients in the REE industry, and over the last two years, they have been evolving in many ways. I have learnt that every project has a different component that makes it different.

The Clay Rare Earth scene is relatively young for the industry. China has been working on these deposits for a while, but the flow of information has been limited. We also understand that the extraction methods in China are not best practice and will never pass the environmental test in our jurisdiction. To top all that off, the Chinese market is pretty much controlled, and it is the kingmaker for the REE market to the world.

Recently, the world has woken up to the need for a second source of raw REE, which has created more confusion. There appears to be a knight in shining armour, but people can't seem to feel that the knight is there permanently or that perhaps it's a mirage.

There is an increasing demand for REE, so there must be a source for these materials. Like all commodities, the supply needs to meet demand. There is no such thing as something so rare that demand will drive pricing to high levels. There is a thing called affordability, which I feel is the overwhelming driver for the equilibrium of demand vs. supply.

Affordability is also the driver for the question of for economic viability, a deposit needs to become viable. What Cobra is proposing and driving towards may be the difference between the Cobra deposit and those promoting better numbers.

Time will tell, but this allows potential investors like us time to DYOR. Cobra will need to raise more money to operate, and I would assume that, based on Rupert's comments, a listing on the Australian Stock Exchange (ASX) looks to be on the table.

Get Deeper Insights

The latest and most reliable information from experienced sources, that are completely unbiased are now available through a Paid Membership. Sign up here for a more trustworthy source of well-researched and independent information for investors.

-------

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

------

About Samso

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

댓글