Chariot Corporation conquers Wyoming with a 206% increase in Black Mountain Lithium Tenure; Riding on Significant Lithium and Base Metal Hits.

- Noel Ong

- Mar 29, 2024

- 4 min read

After a dismal IPO in late October, during which shares dropped nearly 50%, Chariot Corporation Ltd (ASX: CC9) immediately hit the ground at its flagship Black Mountain Project in Wyoming, looking to turn the tides in its favour.

At the outset, the company faced challenging early winter conditions that led to issues such as freezing of the water source, water and diesel lines, water truck breakdowns, and blocked access roads—not to mention the gloomy lithium prices.

However, as results started to come in from the company’s maiden drill program, Black Mountain, things started to take a turn for the better for the North American Lithium explorer who intersected ‘significant’ lithium and base metal hits – which the company described as “stunning”.

Interestingly, this is the first hard rock lithium discovery through drilling in Wyoming.

The company has expanded its land position in Wyoming to 206% and increased its Wyoming lithium portfolio to 93.9% - cementing its confidence in the project.

Chariot shares are trading as high as $A0.31 today, up 24% from the opening price ( Figure 1).

Figure 1: Chariot share price chart (Source: Google Finance).

“Stunning” Results

Black Mountain’s maiden drill program has delivered strong initial hard rock lithium results with multiple mineralised lithium intersections from the first three holes.

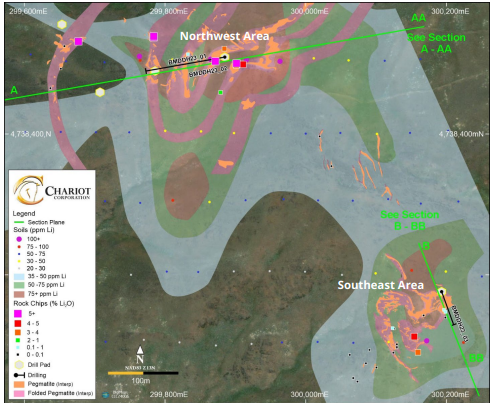

During the program, all holes intersected high-grade spodumene mineralisation, confirming the potential of the Black Mountain LCT pegmatite swarms (Figure 2).

Figure 2: Plan View of the Black Mountain Project, showing the pegmatite outcrops (dark red) and interpreted folded geometry (in light red) along with the Northwest and Southeast Cross-Section Lines and Drill Collars (Source: ASX release).

Notable results include:

BMDDH23_01 15.48m @ 1.12% Li2O and 79ppm Ta2O5 from 2.74m, including 4.27m @ 2.46% Li2O and 128 ppm Ta2O5 from 9.94m;

BMDDH23_02 14.33m @ 0.84% Li2O and 61ppm Ta2O5 from 1.83m, including 2.29m @ 3.09% Li2O and 138ppm Ta2O5 from 10.67m; and

BMDDH23_03 18.81m @ 0.85% Li2O and 98ppm Ta2O5 from 45.26m, including 5.79m @ 1.08% Li2O and 105ppm Ta2O5 from 47.55m.

These drill results confirm the potential of the Black Mountain lithium caesium tantalum (LCT) pegmatite swarms, with the assays returning individual lithium and tantalum values of up to 3.79% lithium and 230ppm tantalum.

Furthermore, the company is optimistic it may have intersected the peripheral portion of a potentially larger base metal mineral system, with selected intervals grading up to 0.6% copper, 1.0% zinc and 15.4% lead.

Wyoming Expansion

As part of its Wyoming expansion, Chariot has now increased its landholding in Wyoming to 218 contiguous claims, resulting in a 206% increase in project tenure area (Figure 3).

The Black Mountain project now comprises 352 claims covering 2,686 hectares of tenure.

Meanwhile, Chariot increased its ownership of Wyoming Lithium Pty Ltd from 91.9% to 93.9% via a share subscription to reimburse Chariot for exploration expenses incurred at the Wyoming Lithium Projects.

Figure 3: Black Mountain Project – expanded footprint ( Source: ASX release).

Looking Ahead

As of February, drilling continues with eight holes completed to date, and assay results for the subsequent five holes are pending and expected to be announced by next month.

This information will be used to design a more extensive 5,000- to 10,000-metre phase 2 resource definition drill program, which is expected to kick off in the September quarter.

In anticipation of the Phase 2 resource drill Program, the initial focus will consist of detailed re-logging of the Phase 1 Program drill core along with a detailed petrographic study of the mineralisation and selection and submittal of samples for initial metallurgical testing.

At the same time, the existing rock chip and soil sampling program will be extended to the north and east to close off the open lithium and base metal anomalies.

In addition, the company plans to run a preliminary IP/Resistivity survey over the area of anomalous Zn-Pb soil geochemistry to assist in siting several holes to test the nature of this base metal mineralisation in September and December quarter of 2024.

Company Background

Chariot has twelve lithium projects, including two core projects and a number of exploration pipeline projects, which Chariot's majority own and operate.

The core projects include the flagship Black Mountain Project in Wyoming, USA and the Resurgent Project (prospective for claystone lithium) in Nevada and Oregon, USA ( Figure 4).

Figure 4: Chariots Wyoming portfolio.

Wyoming is a tier 1 mining jurisdiction with a long history of gold, uranium, coal and industrial minerals mining and production, accounting for approximately 20% of the state’s GDP in 2023.

Wyoming is currently the 8th largest oil and gas producer in the U.S.A. with a well-established oil field services industry.

Chariot has already engaged a number of oil field service providers to provide various services for the phase 1 drilling program at Black Mountain and anticipates further leveraging of the available local oil field service providers for future exploration and mine development activities.

Get Deeper Insights

The latest and most reliable information from experienced sources, that are completely unbiased are now available through a Paid Membership. Sign up here for a more trustworthy source of well-researched and independent information for investors.

-------

Disclaimer

The information or opinions provided herein do not constitute investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not take into consideration, nor have any regard to your specific investment objectives, financial situation, risk profile, tax position and particular, or unique needs and constraints.

------

About Samso

Samso is a trusted platform that equips dedicated investors with up-to-date industry knowledge and insights from top CEOs and thought leaders. By staying informed on business advancements and market trends, investors can enhance their financial decisions through a combination of expert guidance and their own research.

Comments